- Start saying “Thank you”, stop saying “Sorry”You have responded to a customer at a time that is significantly beyond the anticipated response time. Instead of saying, “Sorry for replying late,” try… Read more: Start saying “Thank you”, stop saying “Sorry”

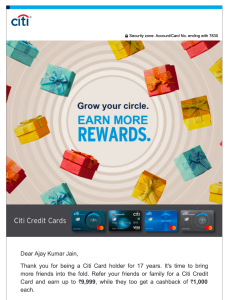

- 17 years of using Citibank Credit CardToday Citibank sent an email reminding that it has been 17 years since I am using their card. Feels great. Isn’t it? Here is what… Read more: 17 years of using Citibank Credit Card

- Quora (हिंदी) पर मेरा वर्ष 2019Quora (हिंदी) पर मैं ज़्यादा एक्टिव नहीं हूँ। फिर भी जो थोड़ा बहुत समय मैंने वहाँ बिताया है, उसका लेखा जोखा प्रस्तुत है इस पोस्ट… Read more: Quora (हिंदी) पर मेरा वर्ष 2019

- Be Productive, Be Healthy, While Working RemotelyA talk by Ajay and Suyogya during WordCamp Udaipur, 2019 What is the WHO definition of health? Health is a state of complete physical, mental… Read more: Be Productive, Be Healthy, While Working Remotely

- My year 2019 on Quora (English)Quora sent me a summary today about my year 2019 on Quora (English). Watch for another post for my 2019 on Quora (Hindi). Here are… Read more: My year 2019 on Quora (English)

- 10 years of body detoxification2019 – The conclusion https://www.facebook.com/akumarjain/posts/10158371735813514 2018 – Almost there https://www.facebook.com/akumarjain/posts/10157259967973514 2017 – The beginning repeats itself with 11 days https://www.facebook.com/akumarjain/posts/10156021791668514 2016 – Inching closer to… Read more: 10 years of body detoxification